If you are convinced that investment agriculture is a good way to diversify your overall portfolio — and we hope you are — then how do you properly allocate your investments across different types of deals to maximize your returns and safeguard your principal? Agriculture is a hugely diverse investment class, offering many ways to spread your risk among various operations.

Vary Your Geography

Investments in U.S. farming operations offer familiarity, currency stability, and an assurance of modern production techniques that maximize crop yield and profitability. On the other hand, overseas ag investments can offer a currency hedge against deflation of the U.S. dollar. Investing in emerging and frontier markets can also bring promises of higher returns due to land and labor arbitrage. Performing due diligence on an offshore investment can be daunting. Look for partners with "boots on the ground" and a track record of operations in the specific market.

Consider Production Methods

There are about as many ways to grow food as there are to cook it. Each of these production methods brings various benefits to investors and consumers. Take egg production, for example. Eggs can be produced cage-free, organic, conventional, and free-range, just to name a few.

Ongoing debates between organic, conventional, and non-GMO methods of production rarely mention that all of these forms of agriculture can make profitable investments, depending on how the deals are structured. Likewise, despite the increasing popularity of indoor agriculture and novel production systems, outdoor farming isn't going away any time soon, simply because of the economies of scale these growers enjoy.

Relative returns and risks are also a factor of the maturity of a particular production operation. Midwest farmland that has been producing row crops for multiple decades is a fairly low risk form of investment. Funding a start-up vertical farm development can bring much higher returns, but at a higher risk premium.

Different Crops Types Yield Different Returns

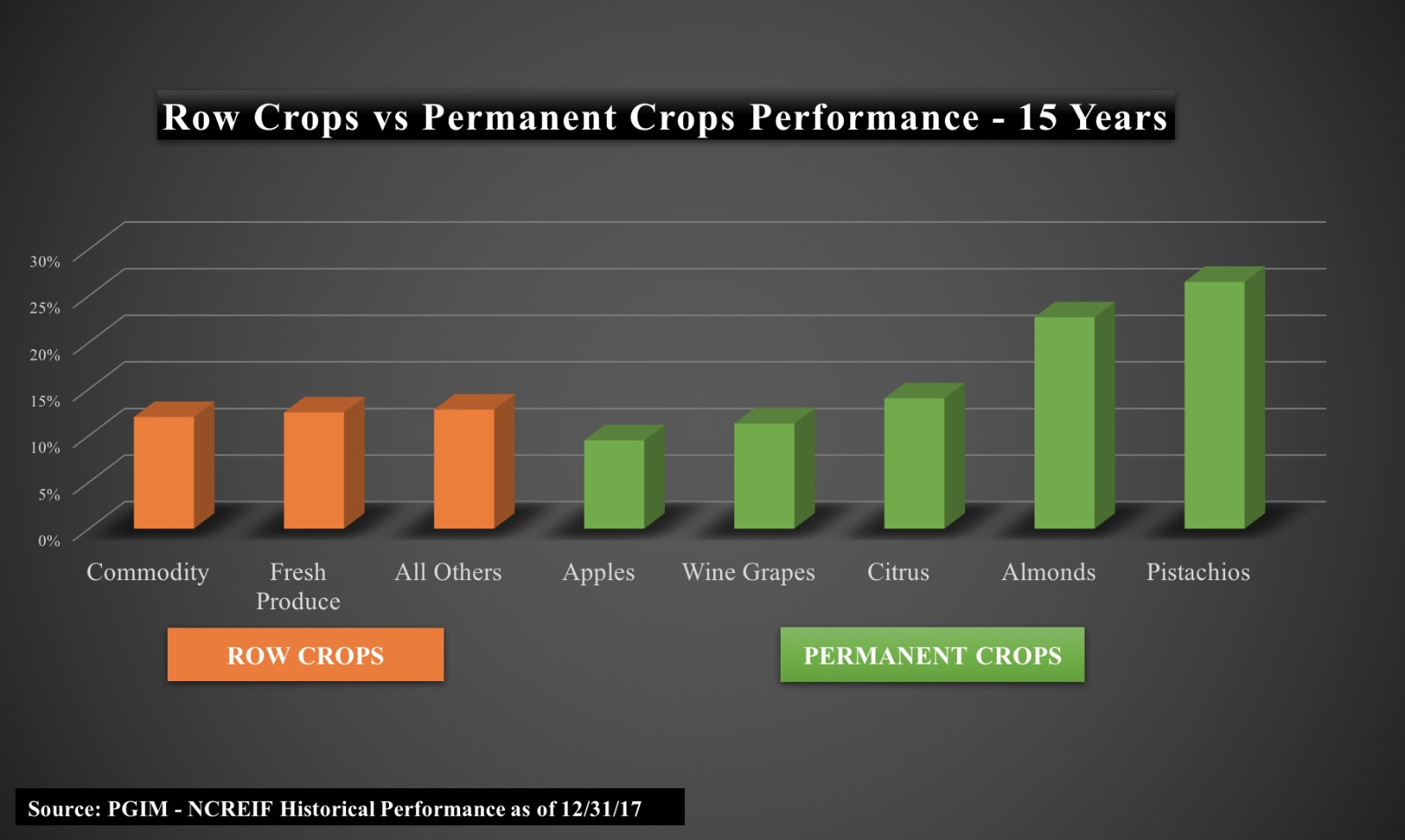

Investment returns from various crop types can vary widely, with these differences based on supply and demand factors, consumer preference, and commodity prices. Row crops, like corn, soybeans and wheat, are planted year after year, providing a steady annual return, but a strong dependence on weather conditions and commodity prices. Permanent crops, like apples, grapes, and pecans, are harvested from the same trees every year, and can bring higher returns due to demand trends. For example, nut tree crops — almonds, pecans, pistachios and walnuts — are particularly strong thanks to health-conscious consumers and exports to a growing middle class in emerging markets, according to the Institutional Investor.

Building Your Portfolio

It's not wise to put all of your eggs in one basket, even in agriculture investments. Take some time to get to know different markets, crop types, and production methods before building your investment portfolio. Fortunately, because of our lower investment minimums, KrogerFarms allows you to spread your natural resource portfolio across several deals, reducing your risk in any one operator or commodity type.