By Heinrich Wittleder

KrogerFarms' opportunities are structured in a variety of ways that produce different return profiles. Here are three of the most common metrics used in evaluating an investment as with an explanation of their advantages and disadvantages.

Internal Rate of Return

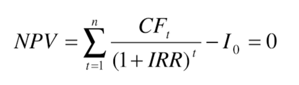

The internal rate of return IRR is a very common metric in equity asset investment. It is the discount rate that makes the net present value (NPV) of all cash flows from the investment, across time periods, equal to zero.

One of the main features of the IRR is that it takes the time value of money into account. The IRR is similar to the concept of “net present value,” and measures, as a percentage, the return rate earned on an investment during a specific time frame, assuming a reinvestment of cash flows at the same return rate.

The IRR is a robust tool since it does not focus on a single moment in time, but rather factors in the continuous cash-flow in future periods. IRR analysis is also helpful in allowing investors to consider changing operating or exit assumptions over time.

As a discount rate, IRR accounts for the time an investor’s money is tied up in an investment. Holding all else constant, the more time periods the investment comprises, the lower the IRR. Since the “time value of money” looms large for active investors, this feature is the main reason IRR is so commonly cited.

While the IRR does incorporate time, it is not the best metric tool for assessing overall profit potential for an investment. Investments with a short time horizon may show an exorbitant projected IRR, despite low projected profit. Moreover, the IRR tells little about the distribution of cash flow throughout a project. Two investments with the same hold period may have an identical IRR, with one returning all principal and profit only at the end of the term upon sale, and the other returning consistent cash flow throughout. Investments that offer stable cash flow are typically preferable, as they entail less risk and offer the opportunity to put capital to work elsewhere sooner.

Like all investment metrics, the main drawback of the IRR is its inherent dependence on future assumptions of cash flow and potentially biased projections of future factors. In agriculture, mother nature gets a vote. Unforeseen expenses, varying crop yields due to bad weather, and other factors are difficult to predict and impact future profitability.

Equity Multiple

The main purpose of an equity multiple is to provide an easy to understand snapshot of the overall profitability of an investment. Equity multiples are one of the core evaluation methods for investing opportunities. The metric is calculated as follows:

Equity Multiple = (Total Profit + Max. Equity Invested) / (Max. Equity Invested)

For an investment of $10,000 and a projected profit of $3000 that would mean:

Equity Multiple = ($3,000 + $10,000) / $10,000 = 1.3x

Simply put, this means you earn your money back plus 30% on your initial investment.

Like most metrics, the equity multiple has some disadvantages. First, it does not regard time value of money and the duration in which the investor’s money is tied up.

Given the same $10,000, imagine you are offered an investment with an equity multiple of 2.0x over 10 years. Despite the high multiple, your money back plus 100%, the high duration of this investment makes it unattractive.

Second, it does not incorporate distribution of cash flow throughout the lifetime of the project. Imagine that the investment paid $5,000 in profit after 5 years period, but only in one single payment upon sale. This option would be less appealing, as the investor would forego the opportunity to reclaim capital and put their money back to work throughout the lifetime of the project.

Capitalization Rate

The capitalization rate is a very simple financial ratio to describe the profitability of an investment. It is calculated by dividing the investment’s Net Operating Income (NOI) by its current market value. Since the Cap Rate is a ratio, the number is expressed as a percentage. A farm’s Net Operating Income is generally expressed in annual revenue less its operating costs. Non-cash flow expenses, such as capital improvements and depreciation, are generally not included in NOI, since these are either extraordinary or non-cash expenses. The cap rate is useful as a basic valuation measure for a certain point in time, since an investor can see how a farm’s valuation compares to similar investments.

If an investment has a net value of $1 million and a NOI of $100,000, the cap rate would be 10%. A property that’s valued at $500,000 with an NOI of $25,000 would have a cap rate of 5%. A higher cap rates usually indicates a more favorable valuation, and potentially a higher expected return.

Just like the equity multiple does the cap rate not take into account factors like future growth of the property’s income, changes in investment values and the “time value of money.”